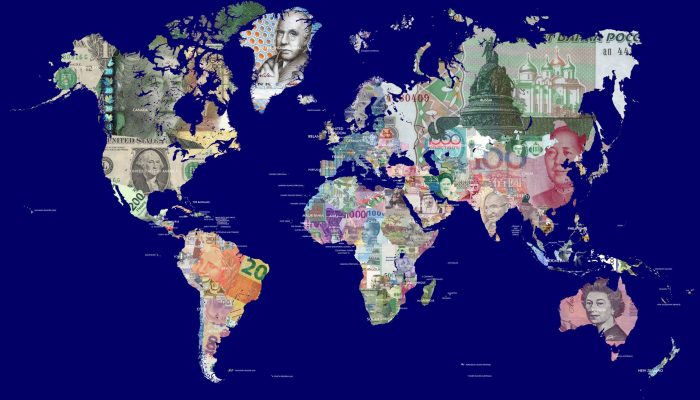

All The Money In The World

Posted September 20, 2018

Earlier Macro Watch videos this year have shown how the central banks of the United States, Japan, Europe and China have created money on a multi-trillion dollar scale and deployed it in order to achieve particular domestic policy objectives.

The new Macro Watch video presents a broader perspective. It looks at the Monetary Base of the entire world. Astonishingly, the Global Monetary Base has expanded 23-fold in just 32 years, from $800 billion in 1985 to $18.4 trillion in 2017.

The video begin by explaining how the creation of unprecedented amounts of central bank money after the breakdown of Bretton Woods destabilized the global economy and caused the Crisis of 2008. It then shows that the creation of more money, on a much larger scale, prevented that crisis from turning into a new global great depression.

Next we see that the impact that central bank money creation has on an economy doesn’t depend solely on the quantity of money created. It also depends on how the central bank deploys the newly created money or, in other words, according to the type of assets the central bank acquires with the money it creates.

When a central bank creates money to acquire a domestic asset, the consequences for the economy and for the financial markets are quite different to those that occur when it creates money to acquire a foreign asset. Policymakers are aware of this difference. Investors need to be as well.

The difference in the consequences resulting from domestic asset purchases versus foreign asset purchases is illustrated by analyzing the evolution of the balance sheets of the Fed, the Eurosystem, the Bank of Japan and the Bank of England, on the one hand, compared with changes in the balance sheets of the People’s Bank Of China and the Swiss National Bank on the other. The former created money primarily to buy domestic assets. The latter created money primarily to buy foreign assets.

The video ends with a discussion of money creation and inflation. The Global Monetary Base grew by 23% in 2007, 39% in 2008 and by 32% in 2011. Over the last two years it has increased by an average of 11% a year. In the past, when central banks created money, that generally led to high rates of inflation. Today, it no longer does because Globalization is so deflationary. Consumer price inflation for the world has been only 2% a year for the last three years.

The fact that aggressive central bank money creation is not producing high rates of inflation is the most consequential economic development in the modern era. It has made Money creation by central banks the most powerful tool available to economic policymakers.

How that new money is used during the years and decades ahead will determine not only whether asset prices move up or down, it will determine how rapidly the global economy grows and who will benefit from that growth.

To understand All The Money In The World, Macro Watch subscribers can log in and watch this video now. It is 23-minutes long and offers 48 downloadable charts.

If you have not yet subscribed to Macro Watch and would like to, click on the following link:

SUBSCRIBE TO MACRO WATCH

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: base

You will find 46 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Please share this blog with your colleagues and friends.

No comments have been made yet.